Why Gold Is Likely to Reach $5,000 Soon

Oct 11, 2023

Gold has been trading sideways for the past three years, testing the all-time high, correcting toward support levels, and seeking an opportunity to break out to much higher levels. The technical indicators for gold suggest it's currently oversold and entering a positive momentum phase. With the Federal Reserve's monetary tightening cycle nearing its end, a surge in gold prices and the onset of a bull market stampede appear imminent. I anticipate gold reaching $5,000 in the next 2-3 years, and top gold mining companies could appreciate several-fold. This perspective has been explored in more detail with members of my private investing community, The Financial Prophet.

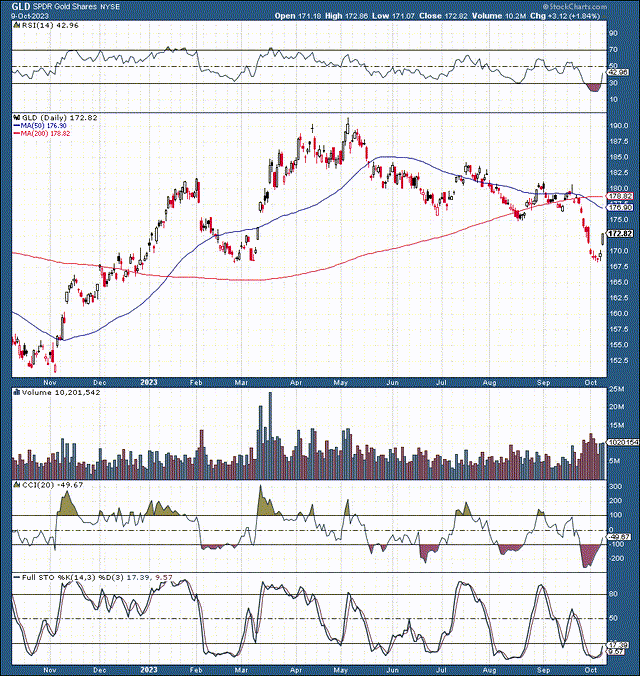

A Period of Sideways Movement After experiencing significant growth in 2019 and 2020, gold has been trading sideways for approximately three years. During this time, gold has moved within a narrow range, testing its all-time high (ATH) at around $2,100 and undergoing a correction of approximately 20% towards the crucial support levels of $1,600 to $1,650. It's worth noting that gold has maintained this sideways trend despite the prevailing tight monetary conditions, which would typically weigh on the precious metal.

Gold's Attempts to Break Out Gold has made several attempts to decisively break out to new ATHs. The first attempt occurred in 2020 when the gold market was significantly overbought. The second attempt took place in 2022, but it was thwarted by overbought market conditions and the Federal Reserve's initiation of monetary tightening. More recently, in early May, gold made another attempt, but it was rejected due to concerns about further interest rate hikes in 2023.

However, we have now witnessed a robust long-term consolidation process for gold. Furthermore, gold's Relative Strength Index (RSI) recently dropped to approximately 20, marking one of the most oversold technical conditions seen in the past five years. The full stochastic indicator is now turning upward, signaling that gold is entering a more positive technical momentum phase.

Favorable Fundamental Factors In addition to these promising technical indicators, gold's fundamental backdrop is increasingly favorable. Crucially, the Federal Reserve is nearing the end of its monetary tightening cycle, and we are likely at the peak of interest rates. Gold tends to perform well as the Fed pivots toward a more accommodative monetary stance, as seen during previous easy monetary cycles, notably after the post-financial crisis rally and the surge from the 2015 lows.

Anticipated Surge in Gold

We observe gold trading around its previous ATH peak in 2011. Once gold achieves a clean break above $2,100, there will be no significant resistance levels, potentially leading to a rapid and substantial surge in value. In addition to these constructive fundamentals associated with the Federal Reserve and interest rates, gold is poised to benefit from its status as a safe haven. Ongoing conflicts in regions such as Ukraine, the Middle East, and other hotspots continue to fester, bolstering gold's appeal as a hedge.

Global Monetary Supply and Inflation The increasing global monetary supply and mounting debt levels, both in the U.S. and worldwide, continue to rise. While recent inflation has moderated, it is expected to persist, and higher inflation levels may become normalized in the years to come. Consequently, there is a high probability that gold will soon break out to new ATHs. This could trigger a substantial bull market, propelling the precious metal to $5,000 or higher within the next 2-3 years.

The Case for $5,000 or More Gold typically thrives during easing cycles, and as we near the peak of the current tightening phase, the Federal Reserve could potentially start lowering interest rates in H1 2024, approximately 6-9 months from now. Historical bull market rallies have seen gold's value increase by around 100-300%. For instance, in the early 2000s, gold rose from about $300 to approximately $900 in a low-rate monetary environment. A significant rally also occurred, with gold climbing from around $800 to roughly $2,000 during the initial post-financial crisis quantitative easing era.

More recently, we witnessed gold's ascent from approximately $1,050 to over $2,000 as it became apparent that the Federal Reserve's balance sheet would not be reduced as initially expected. If history repeats itself and it becomes clear that the Fed's balance sheet will remain extensive, with the possibility of a return to easing and potential quantitative easing in 2024 to stimulate the economy, gold is likely to experience another substantial rally of 100% or more in the coming years.

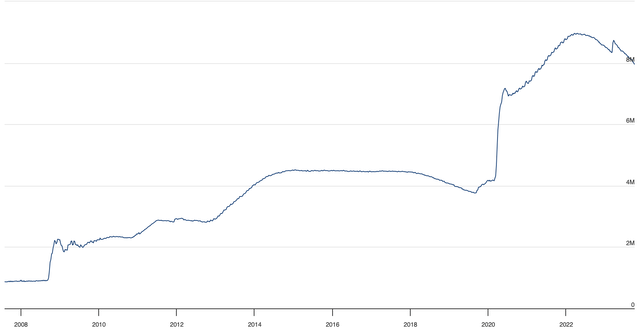

A Familiar Scenario with the Fed's Balance Sheet

The Federal Reserve has reduced its balance sheet by approximately $1 trillion since the initiation of Quantitative Tightening (QT). We witnessed a similar scenario when the Fed briefly introduced tightening and QT in 2017/2018. However, this endeavor ended poorly as the economy nearly slipped into a recession by late 2018. The Fed then reversed its policy, leading to monetary easing and eventual quantitative easing between 2019 and 2021. We are now at another pivotal moment as the interest rate cycle peaks, and the Federal Reserve is expected to shift toward a more accommodative monetary environment to promote economic growth in early to mid-2024.

Consequently, while Quantitative Tightening may persist in the short term, with the reduction of the Fed's balance sheet by another approximately $500 billion, another reversal in balance sheet reduction is likely as the Fed transitions to a more lenient monetary stance. Moreover, it's essential to recognize the Federal Reserve's capability to intervene across various sectors of the economy. If there are "bad mortgages" on bank books, the Fed can purchase Mortgage-Backed Securities (MBS) to prevent a crisis. The Fed can intervene in nearly any aspect of the banking system, municipalities, and the Federal Government to infuse capital, transferring "bad assets" onto its balance sheet. Consequently, we can anticipate further increases in the balance sheet due to potential future quantitative easing and crisis management, driving up demand for gold.

The Fed's Pivot is Imminent

Whether or not the Federal Reserve officially acknowledges it, a pivot towards a more accommodative monetary stance is likely on the horizon. We are witnessing notably high interest rates across the board, with many rates reaching multi-decade highs. The U.S. 10-year treasury, aside from a brief uptick in 2006/2007, is currently at its highest level in over 20 years. High bond yields tend to cool the economy by increasing borrowing costs, and they provide an alternative investment class to safe-haven assets like gold and silver. With yields offering a "safe" return of around 5%, the demand for gold may decrease.

However, it's possible that we have recently witnessed a peak in yields, as the 10-year treasury rate nearly reached 5%. Additionally, mortgage rates, credit card interest rates, and other significant rates have reached multi-decade highs. These rates will need to decrease to avoid a harsh economic downturn, as the current high-rate environment is detrimental to the economy and unsustainable in the intermediate and long term. Consequently, the Federal Reserve is expected to act swiftly to lower rates.

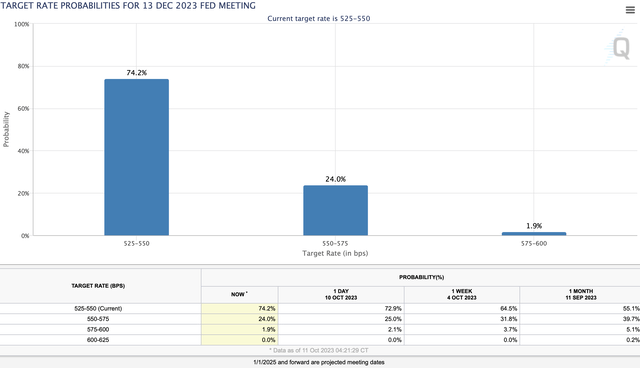

The FOMC's Shift to a More Dovish Stance

The probability of the Federal Reserve raising rates again in 2023 currently stands at 74%. This represents a significant increase from the 54% probability just a month ago, indicating a shift toward a more dovish monetary stance. Furthermore, there is a growing likelihood that the Federal Reserve will commence rate cuts in early to mid-2024. The probability of a 25-basis point (Bps) or more reduction in the benchmark rate by mid-2024 stands at approximately 70%. This trend suggests that the Federal Reserve has reached the apex of the interest rate cycle, and rates are expected to moderate in the near future.

Benefiting Gold Miners as Gold Prices Rise The positive sentiment surrounding gold and the safe-haven demand will likely bolster gold miners. Investors tend to turn to gold during times of conflict and uncertainty, which could translate into exceptional performance for top companies in the gold mining sector. Furthermore, gold recently underwent a constructive correction, and multiple favorable fundamental factors are poised to drive prices higher in the intermediate and long term.

SPDR Gold Shares ETF (GLD)

The SPDR Gold Shares ETF (GLD) is one of the largest gold ETFs globally, seamlessly tracking the price of gold. Gold experienced a substantial 13% correction after reaching its peak in early March. Factors contributing to this decline included high interest rates and a strong U.S. dollar. However, these transitory factors are expected to subside, providing room for gold to appreciate significantly.

GLD reached a highly oversold state, with its RSI dropping to around 20. Furthermore, the Commodity Channel Index (CCI) fell well below -200, marking the most oversold technical conditions observed in over a year for GLD. The full stochastic indicator is now turning upward, signaling a shift toward more favorable momentum.

Top Gold Mining Stocks Top gold mining stocks have also encountered notable oversold conditions recently. For instance, Agnico Eagle Mines (AEM), one of the preferred names in the sector, experienced a decline from a high of around $60 in March to just $43, marking a 28% drop. The company is anticipated to report revenue growth of approximately 15% this year and trades at a forward (2024) price-to-earnings (P/E) ratio of less than 20, along with a dividend yield of around 3.6%.

AEM and other high-quality gold mining stocks are likely to benefit from better-than-expected revenue growth and higher income as the price of gold rises in the coming years.

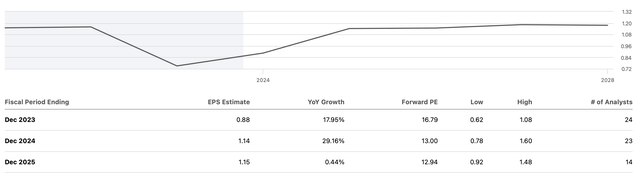

Barrick Gold (GOLD)

Is another strong contender in the gold mining industry and recently experienced a similar, albeit slightly more significant, 32% decline. Barrick is expected to witness revenue growth of about 9% this year, along with earnings per share (EPS) growth of around 18%. The company's current valuation is considered attractive, trading at approximately 12-13 times next year's consensus EPS estimates, and it offers a dividend yield of 2.8%. It's worth noting that consensus EPS estimates appear stagnant, suggesting that they are based on the assumption of a static gold price. However, should the price of gold surpass $2,000 and continue rising to $5,000 or higher, Barrick and other high-quality mining companies are likely to experience considerable EPS growth in the years ahead.

Conclusion The gold market is poised for exciting developments in the near future. With favorable technical indicators, a constructive fundamental backdrop, and the Federal Reserve's pivot towards a more accommodating monetary stance, gold is well-positioned to surge beyond its previous all-time high. This potential rally could lead to a substantial increase in gold prices and significant appreciation in the value of top gold mining companies.