Why Certified Silver Eagles Command Premiums During Record Silver Prices

Jan 06, 2026

Posted by LCR Coin, Inc

As silver prices reach historic highs, many buyers assume the best move is to focus solely on metal content. But experienced collectors and long-term investors often take a different approach—shifting attention from raw silver weight to certified, top-grade Silver Eagles.

This behavior isn’t new. In fact, it has repeated itself across multiple silver bull markets. Understanding why certified Silver Eagles command stronger premiums during periods of rising silver prices can help buyers make more informed decisions.

Silver at Historic Highs: What Changes for Collectors

When silver prices rise sharply, the market typically sees two distinct types of buyers:

-

Short-term buyers focused on metal exposure

-

Experienced collectors focused on quality, condition, and long-term demand

As prices climb, raw silver products often track spot prices closely. Certified Silver Eagles, however, operate in a different market—one driven by collector demand, condition rarity, and population data rather than metal content alone.

This is where premiums begin to separate.

Why Premiums Expand When Silver Prices Rise

During strong silver markets, demand for trusted, certified products increases for several reasons:

-

Buyers become more selective with higher capital outlays

-

Counterfeit concerns increase as values rise

-

Liquidity becomes more important in secondary markets

Certified Silver Eagles offer consistency, authentication, and condition assurance—qualities that become increasingly important during periods of rising silver prices. As a result, premiums on top-grade coins often expand faster than those on raw silver products.

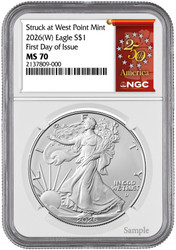

MS70 vs BU Silver Eagles: The Difference Becomes Clear

In stable markets, the premium gap between Brilliant Uncirculated (BU) and MS70 Silver Eagles may appear modest. During strong silver markets, that gap often widens.

MS70 Silver Eagles represent:

-

A perfect strike with no post-production imperfections

-

A limited population relative to total mintage

-

Consistency across collections and registry sets

When prices rise, collectors tend to favor coins with clearly defined quality and long-term desirability. MS70 Silver Eagles meet that demand in a way raw or uncertified coins cannot.

Proof Silver Eagles and the Role of PF70

Proof Silver Eagles graded PF70 occupy an even more specialized segment of the market. These coins combine:

-

Specialized striking techniques

-

Lower mintages

-

Strong collector demand

In rising silver markets, PF70 Proof Silver Eagles—especially those featuring special design elements or historic themes—often maintain premium stability even during periods of price volatility.

Privy Marks and Anniversary Issues: Demand Beyond Silver Content

Modern Silver Eagles featuring privy marks or historic themes introduce an additional layer of demand. These coins appeal not only to silver buyers but also to collectors focused on:

-

Limited production

-

Historical significance

-

Long-term collectibility

Anniversary issues and special privy designs tend to attract sustained interest well beyond their initial release, particularly when paired with top-tier certification.

The year 2026 carries added significance for modern U.S. coinage. It marks the 250th anniversary of the United States, as well as the 40th year of American Silver Eagle production. Milestone years like these historically draw heightened collector interest, especially when combined with certified condition and special design elements. Coins tied to dual anniversaries often attract demand beyond their initial release, reinforcing why top-grade Silver Eagles tend to command stronger premiums during periods of rising silver prices.

Why Advanced Collectors Choose Certified Coins Over Raw Silver

As silver prices rise, advanced collectors often prioritize:

-

Certified condition

-

Market liquidity

-

Population transparency

-

Long-term collector demand

Certified Silver Eagles offer a level of confidence and market recognition that raw silver products cannot match. This is why premium-grade examples consistently perform well during strong silver markets.

Why Buying From a Trusted Certified Dealer Matters

Not all certified coins are sourced, handled, or represented equally. Working with an established dealer that specializes in professionally graded modern U.S. coinage provides:

-

Accurate descriptions

-

Reputable grading service partnerships

-

Transparent product representation

-

Long-term market insight

These factors become especially important during periods of heightened market activity.

Final Takeaway: Quality Often Outperforms Weight in Volatile Markets

History has shown that during periods of rising silver prices, collector demand shifts toward quality, certification, and long-term desirability. Certified Silver Eagles—particularly MS70 and PF70 examples—continue to stand out as trusted, liquid assets within the modern silver market.

For buyers looking beyond short-term price movements, certified Silver Eagles offer a compelling balance of precious metal exposure and collector demand.

About LCR Coin

At LCR Coin, we specialize in certified modern U.S. coinage, including professionally graded Silver Eagles from leading third-party grading services. Our focus is on quality, transparency, and long-term collector value—especially during dynamic market conditions.

Explore Certified Silver Eagles at LCR Coin

Collectors looking to apply these principles can explore LCR Coin’s curated selection of certified Silver Eagles, including MS70 and PF70 examples graded by NGC, PCGS, and CAC. Our inventory focuses on quality, certification, and long-term collector demand.